Investment in sustainable protein up 24% in Europe for 2022 despite global economic turbulence

16 February 2023

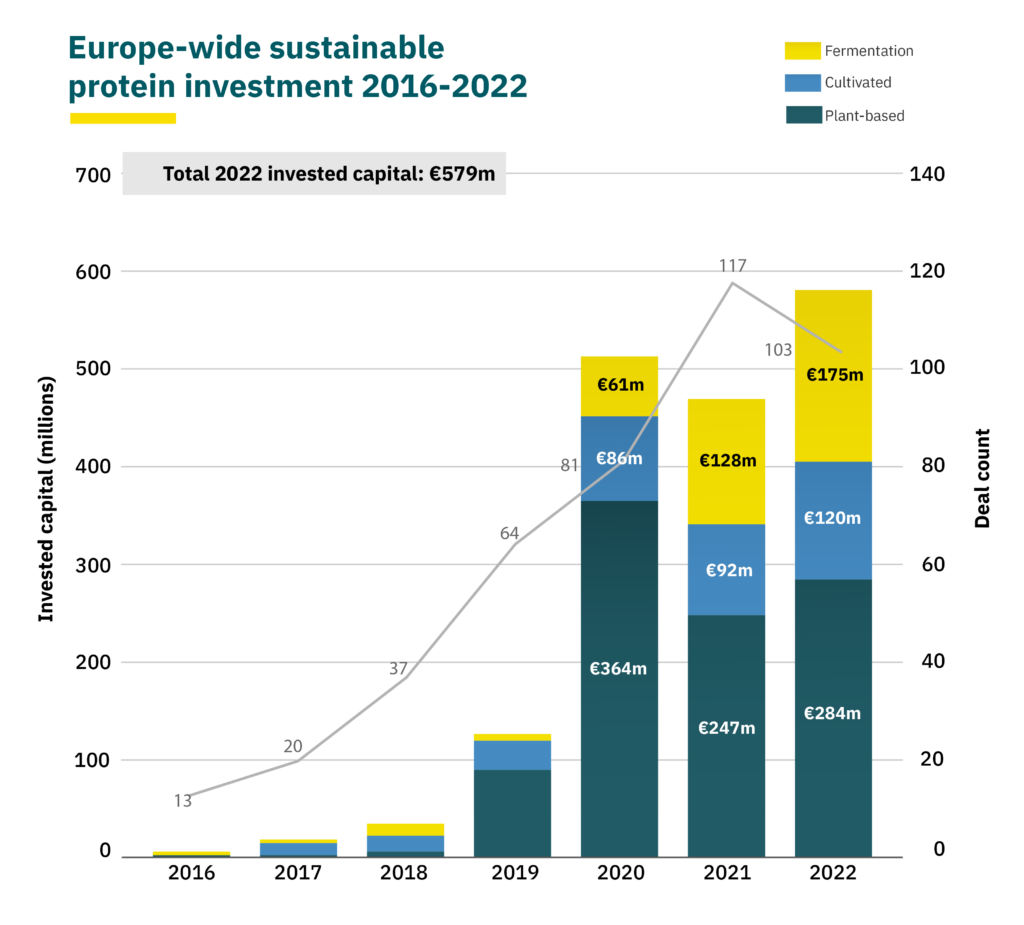

New data reveals sustainable protein companies across Europe raised €579 million ($622 million) in investment last year – nearly 24% more than in 2021 – despite strong global economic headwinds.

New data reveals sustainable protein companies across Europe raised €579 million ($622 million) last year – nearly 24% more than in 2021 – despite strong global economic headwinds.

The Pitchbook figures, released by international nonprofit the Good Food Institute today, show the continent’s plant-based sector saw a 15% increase in venture capital deals, raising €284 million ($305 million) in 2022.

Europe’s cultivated meat companies, which use cultivators to produce the same meat we eat today more sustainably, saw investments jump 30% to €120 million ($129 million). This amounts to more than half of the total raised by European cultivated meat companies between 2016 and 2021.

Investment in the continent’s fermentation companies – which use organisms like yeast and fungi to produce meat, eggs and dairy – shot up by 37% to €175 million ($188 million) in 2022.

Other highlights among the figures include:

- France and Spain both saw investments increase across all sustainable protein categories. French companies raised €168 million ($180 million) – over 11 times more than last year. Spanish companies attracted €42 million ($46 million) – a 58% increase from 2021.

- Investments in the UK’s cultivated meat industry increased almost fourfold, with companies raising €68 million ($74 million) in 2022.

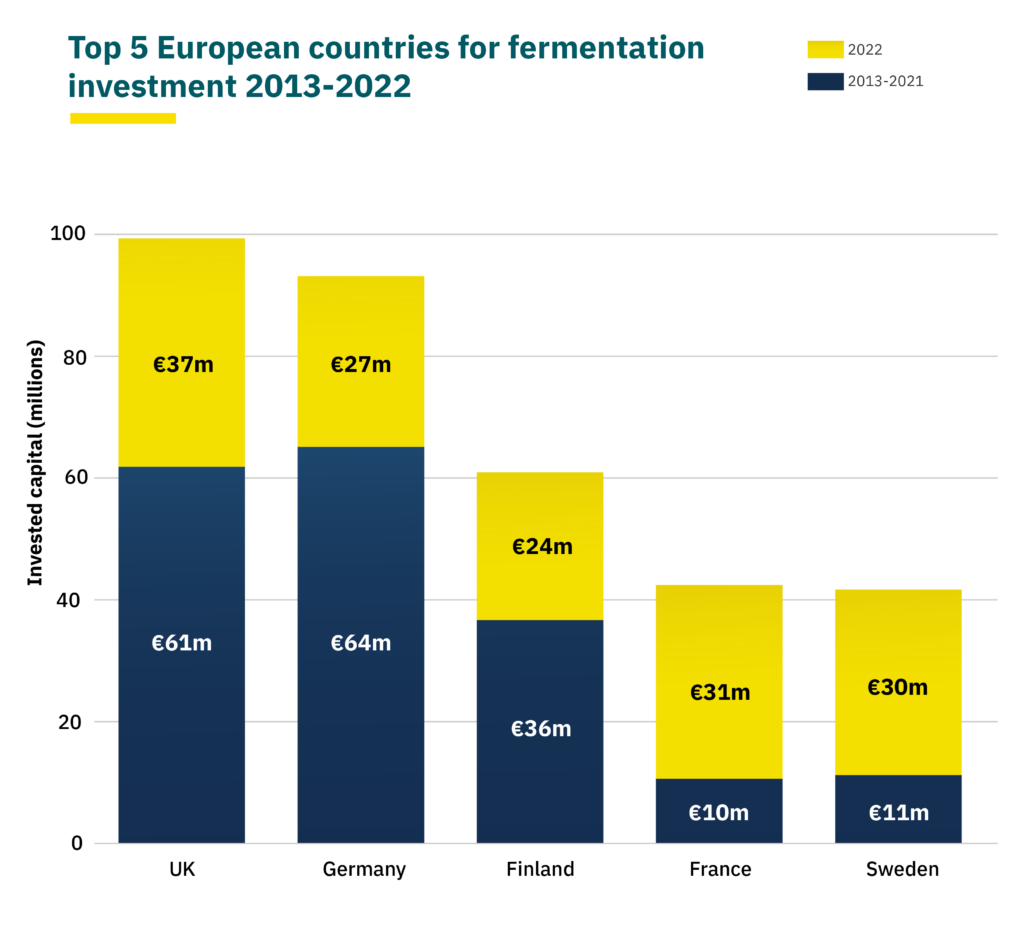

- Scandinavia is fast becoming a fermentation powerhouse, with investment in Swedish companies more than tripling to €29 million ($32 million) and funds raised by Finnish companies more than doubling to €23 million ($25 million).

However, global investment in sustainable proteins decelerated last year, from a record-breaking €4.7 billion ($5.1 billion) in 2021 to €2.7 billion ($2.9 billion) in 2022 – mirroring the marked decline in wider venture capital investment.

Carlotte Lucas, senior corporate engagement manager at the Good Food Institute Europe, said: “It’s great to see such strong figures across Europe’s sustainable protein sectors. But we need to see this against a backdrop of global deceleration, demonstrating clearly that we can’t rely on private investment alone to build a more sustainable food system, and governments need to step up.

“Right now, sustainable proteins are where solar panels were in the 1990s. They exist, and they’re available for eco-conscious consumers who are willing to pay a premium – but they need investment to improve quality and bring down prices.

“With the EU preparing to invest heavily in cleantech and biomanufacturing, now is the perfect opportunity to fund the research needed to keep Europe competitive and create future-proof jobs.”

US President Joe Biden recently signed an executive order directing the US Department of Agriculture to prepare a report “assessing how to use biotechnology and biomanufacturing for food and agriculture innovation, including by… cultivating alternative food sources”.

The aim of the European Commission’s new European Sovereignty Fund – part of the Green Deal Industrial Plan – is “preserving a European edge on critical and emerging technologies, from computing-related technologies, including microelectronics, quantum computing, and artificial intelligence to biotechnology and biomanufacturing and clean technologies”.

According to a report by Boston Consulting Group, plant-based proteins have the highest CO2e savings per dollar of invested capital of any sector – but investment in sustainable foods is only a fraction of that committed to areas like renewable energy.

A new paper from University College London, co-authored by the economist Mariana Mazzucato, finds public research and development funding helps encourage further private investment, accelerates the pace of innovation, and delivers long-term economic benefits.